There are a few reasons why someone would opt to start mining Bitcoin, and they complement each other very well. Ultimately, the reasons to mine bitcoin fall into two important camps: because it’s profitable, and because of the potential of Bitcoin.

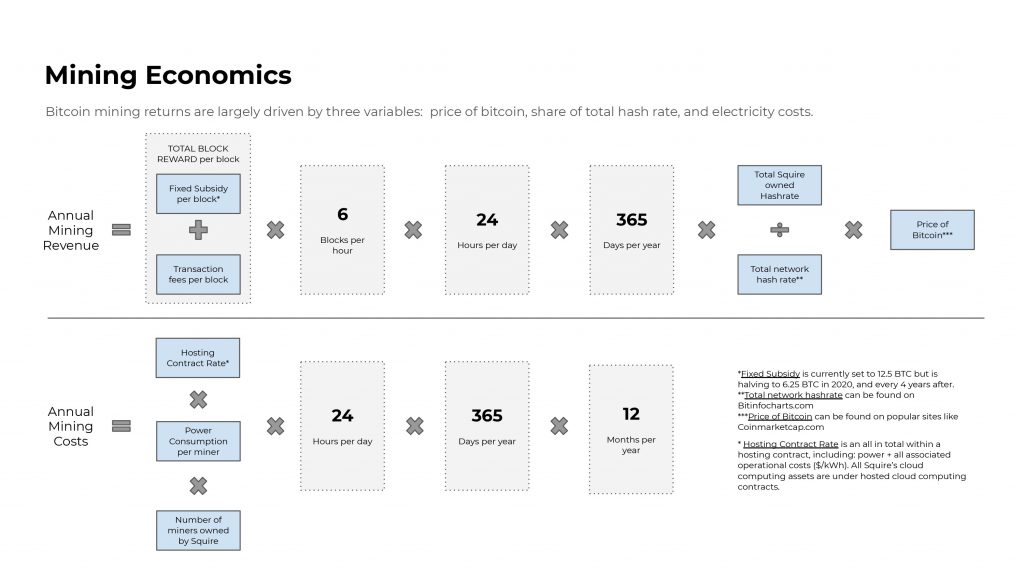

The profitability of mining Bitcoin is an attractive reason to get into the practice. Mining a new block of Bitcoin rewards the successful miner 12.5 Bitcoin at the current rate, allowing the miner to profit from that return. The more hardware and resources a miner has to devote to this task, the more likely they are to receive that reward, incentivizing miners to invest into their operations to make it a likely outcome.

Beyond the block reward, as block sizes scale and are capable of handling more transactions, transaction fees are becoming a big financial incentive to confirm blocks. While every individual transaction carries a small fee, having thousands, and eventually millions of them in each block can start to add up to a nice little profit for those involved in the mining business.

The potential of Bitcoin is another incentive for the Bitcoin miner. The more resources that are put towards mining the Bitcoin blockchain means that the blockchain is more secure, as potential hackers or double-spenders can’t easily overcome the hash rates generated by honest miners. By contributing hash power to the blockchain, miners are making it more secure, and creating more confidence for future users to use Bitcoin without fear of having their transactions suddenly reversed.

This creates a positive feedback loop that’s beneficial to the miner. As the blockchain becomes more secure from the contributions of more and more miners, increased confidence amongst businesses and the public leads to increased adoption. That in turn creates more transactions.

Now that Bitcoin, championed by Bitcoin SV, is pursuing bigger block sizes, more transactions fill each block, resulting in more transaction fees for the miners to collect. That provides an additional profit investive, and a great reason to continue mining. So even if block rewards halve in the future, or all blocks are mined, it remains economically viable to mine Bitcoin for transaction fees.

All talk of profits aside, mining Bitcoin is around creating a new economic model of the future, where peer to peer transactions, without the need for trusted third parties, become the norm. While Bitcoin was designed for miners to profit from this activity, the ultimate motivation to mining is the belief that it will create a better, more inclusive economic future for the world.